International Financial Conglomerates

15,99 €*

Nach dem Kauf zum Download bereit Ein Downloadlink ist wenige Minuten nach dem Kauf im eigenen Benutzerprofil verfügbar.

ISBN/EAN:

9783640988402

Wissenschaftlicher Aufsatz aus dem Jahr 2011 im Fachbereich VWL - Finanzwissenschaft, Note: Distinction, University of Warwick (School of Law), Veranstaltung: International Corporate Governance and Financial Regulation, Sprache: Deutsch, Abstract: International financial conglomerates are the result of the last three decade's policy of deregulation and globalisation. This meant the convergence of commercial banking, investment banking and sometimes insurance in the United States of America with a cross-border expansion. Yet, as has been seen in the recent 2007-2009 crisis (the crisis), those conglomerates create a wholly new host of challenges due to their activities, prime role as counterparty activities in the credit default market, size and structure. Especially their central role in market-financing of other financial institutions as well as other types of companies creates globally systemic risk. A consistent policy which mitigates uncertainty during times of financial crises is essential; however, the rationale behind the US authority behind the ad-hoc responses dealing with AIG, Bear Stearns (BS) and Lehman Brothers Holdings Inc (LB) are very hard to distil, if at all. It can be claimed that there was no consistency in the rescue efforts. In the first case, US authorities injected capital into the ailing company to keep it alive. In the BS case, authorities supported the takeover by JP Morgan using public funds. In the last case, LB, since no potential buyer could be found and authorities did no facilitate any support, the company had to file a petition under Chapter 11.This shows the mechanisms but also difficulties authorities encounter when they deal with those systemic relevant institutions. They have to try to prevent moral hazard incentives, avoid spillovers to other industries and reduce costs to taxpayers. Constructive ambiguity in bail-outs is related to the prevention of moral hazard but increases simultaneously uncertainty, the chance of ill-considered bail- outs, spillovers and delays in regulatory actions. Other mechanisms like capital injections are very costly for taxpayers. The orderly insolvency procedure of systemically relevant institutions seems an appropriate response which mitigates above-mentioned issues when preventing the deterioration of asset value. Existing legislation did not allow, however, the Federal Deposit Insurance Corporation (FDIC) to take the conglomerates under receivership to prevent spillovers and the value deterioration it would experience using the regular bankruptcy regime.

| Autor: | Christian Alexander Mecklenburg-Guzman |

|---|---|

| EAN: | 9783640988402 |

| eBook Format: | ePUB/PDF |

| Sprache: | Deutsch |

| Produktart: | eBook |

| Veröffentlichungsdatum: | 22.08.2011 |

| Untertitel: | The Rise and Fall of the Giants |

| Kategorie: | |

| Schlagworte: | conglomerates distinction fall financial giants international rise |

Anmelden

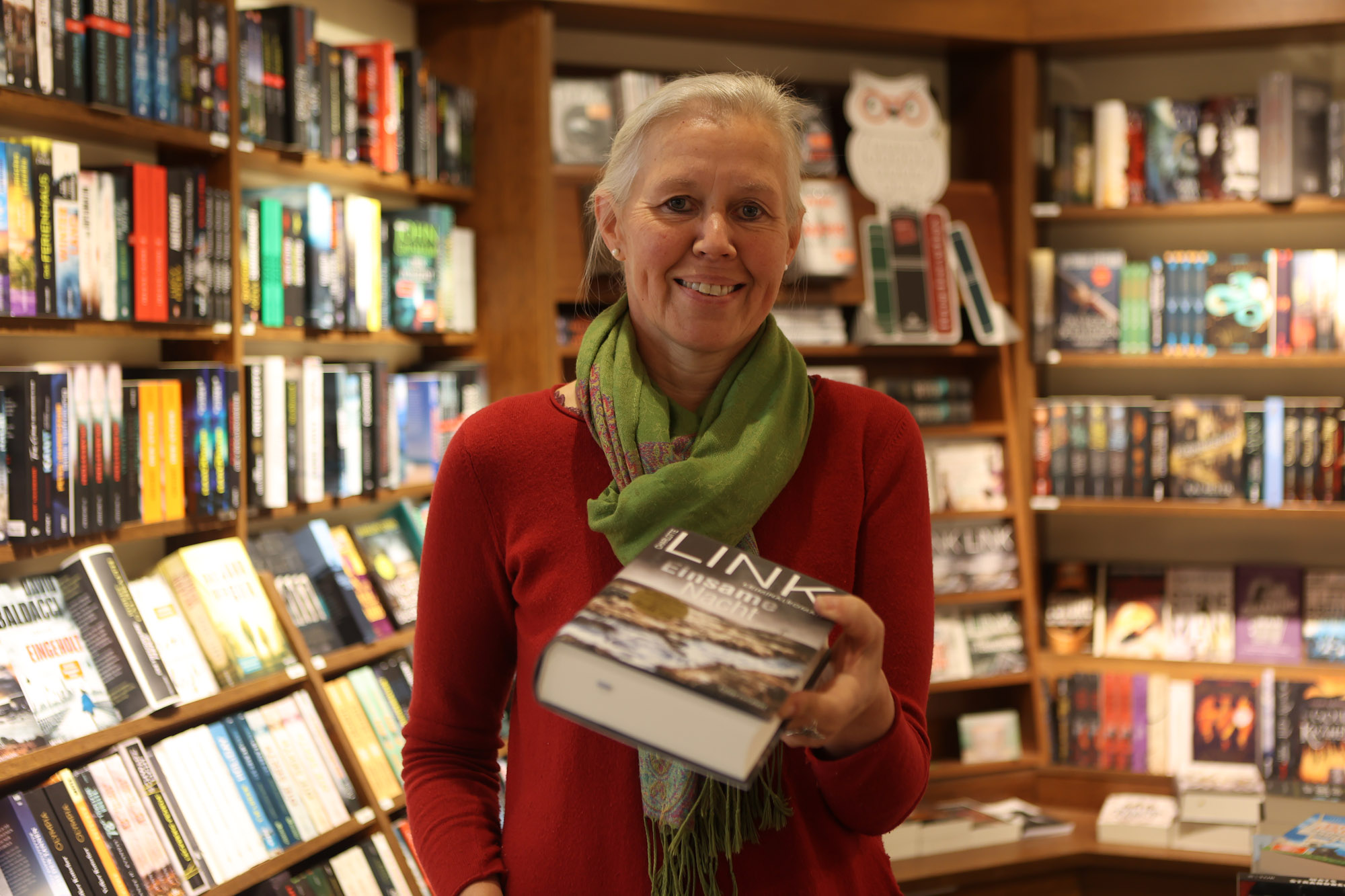

Möchten Sie lieber vor Ort einkaufen?

Haben Sie weiterführende Fragen zu diesem Buch oder anderen Produkten? Oder möchten Sie einfach doch lieber in der Buchhandlung stöbern? Wir sind gern persönlich für Sie da und beraten Sie auch telefonisch.

Bergische Buchhandlung Wipperfürth

Marktplatz 7

51688 Wipperfürth

Telefon: 02267/828340

Mo – Fr09:00 – 18:00 UhrSa09:00 – 13:00 Uhr